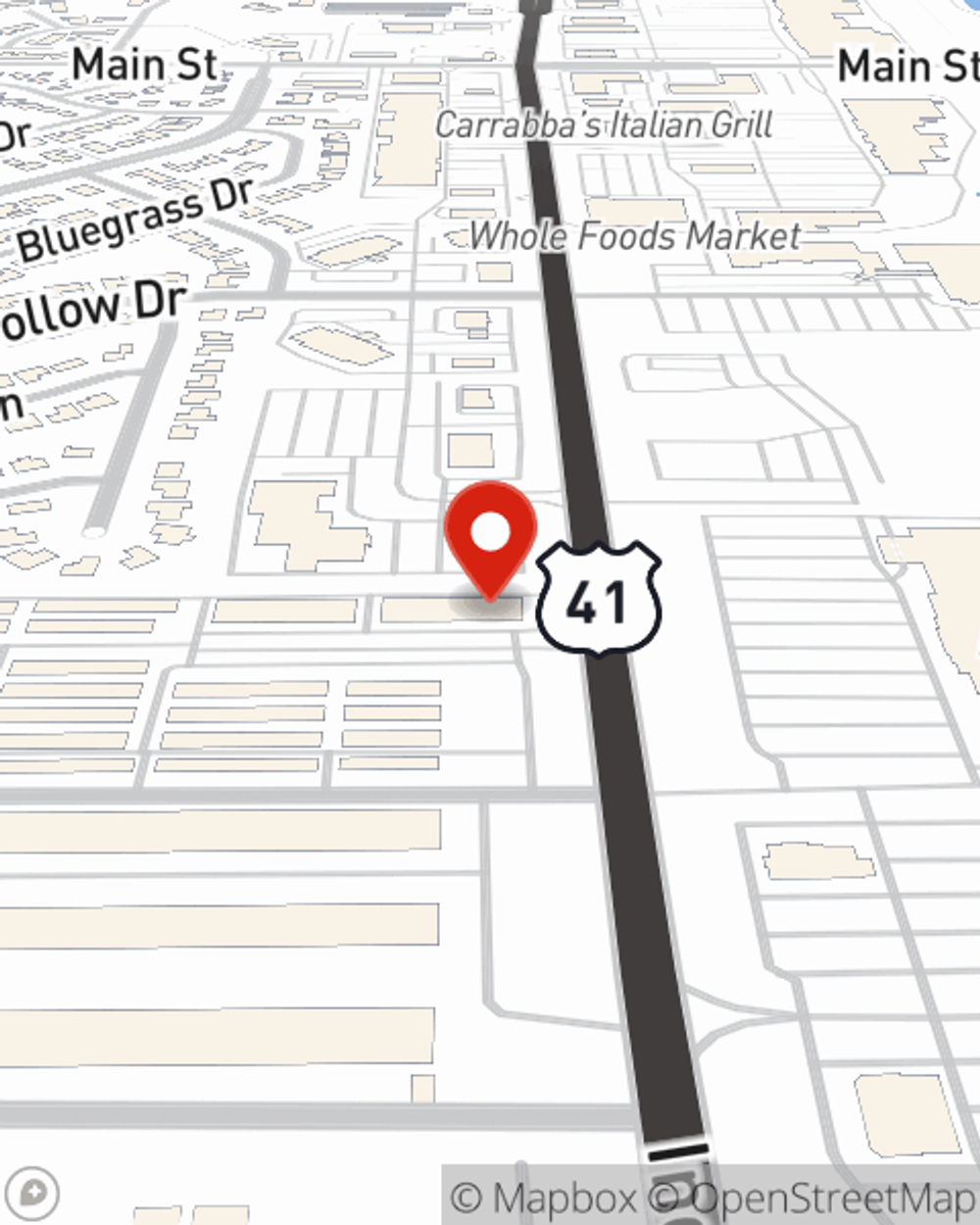

Business Insurance in and around Schererville

Get your Schererville business covered, right here!

Almost 100 years of helping small businesses

Your Search For Excellent Small Business Insurance Ends Now.

Preparation is key for when an accident happens on your business's property like an employee getting hurt.

Get your Schererville business covered, right here!

Almost 100 years of helping small businesses

Strictly Business With State Farm

With options like extra liability, business continuity plans, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Kyle Dempsey is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Ready to explore the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Kyle Dempsey today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Kyle Dempsey

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.